Worker Skills, Firm Dynamics, and Productivity

Joint with Christian Siegel

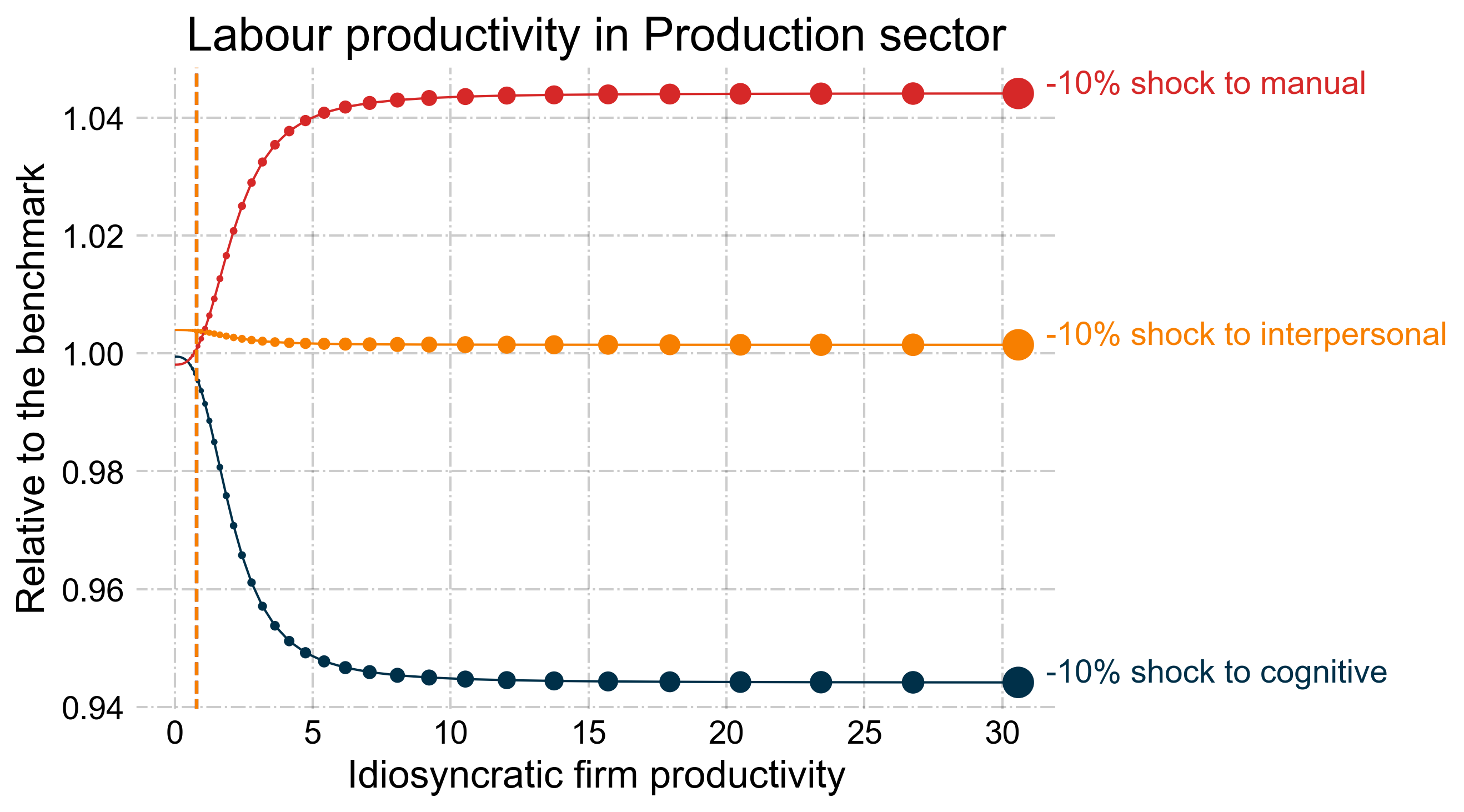

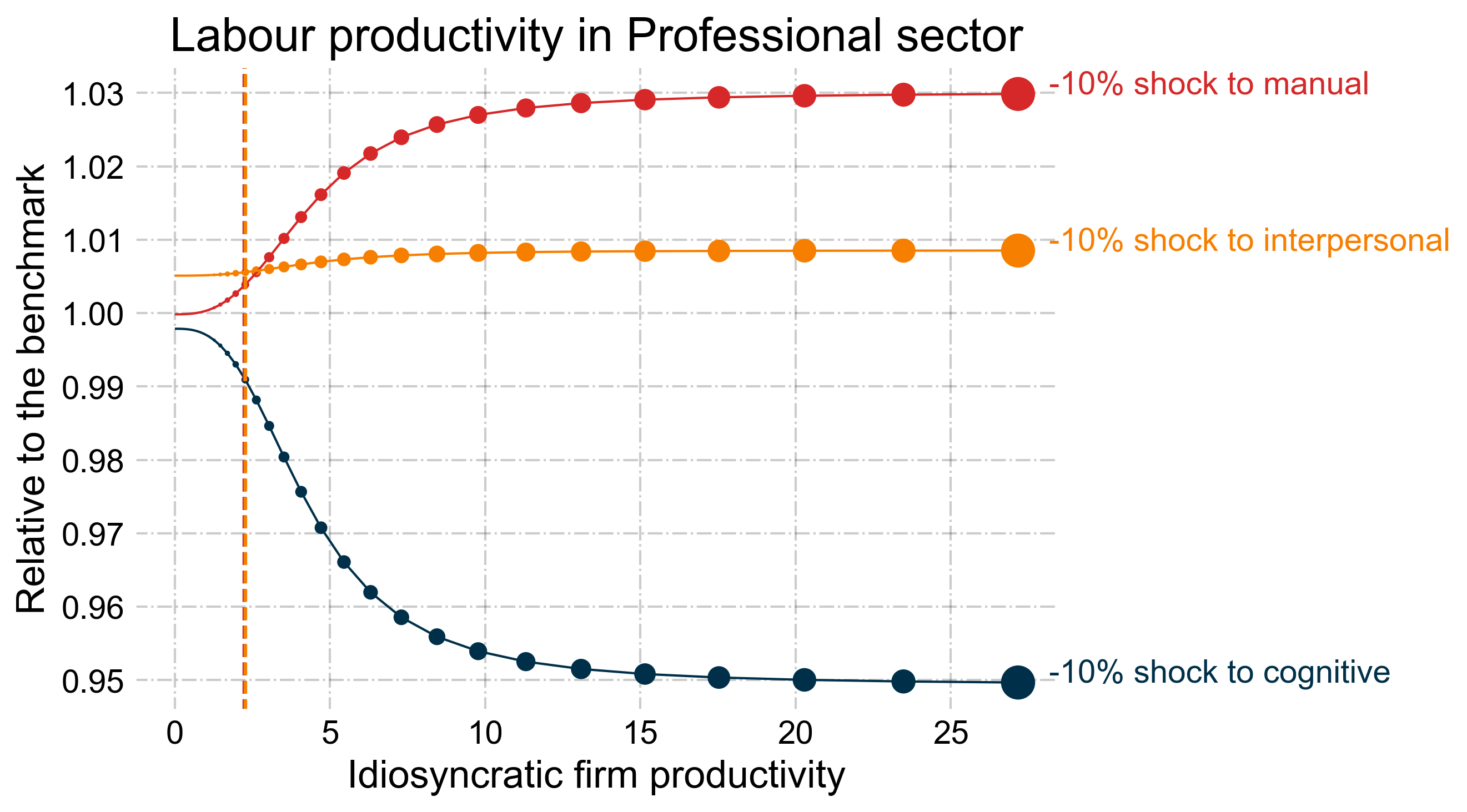

We develop a general equilibrium model of firm dynamics with multiple labour skills to analyse the productivity implications of skill shortages. Firms employ cognitive, interpersonal, and manual skills in both operational and overhead tasks, with sectoral variation in skill intensities, and within sector firm size heterogeneity due to idiosyncratic technology draws. Calibrated to UK data, the model reveals that cognitive skills are a binding constraint on productivity. A reduction in the supply of cognitive skills lowers labour productivity at all levels – firms, sectors, and in the aggregate. About half of the sectoral effects are due to changes in the within-sector distribution, whereby larger firms grow in relative size but become less productive. Sectoral heterogeneity in skill intensities amplifies these effects.

Figure 2a: Production Sector

Figure 2b: Professional Services Sector

Labour productivity for each idiosyncratic firm technology, s, in different economies relative to the benchmark economy. The dashed vertical lines represent the (sector-specific) idiosyncratic threshold s* below which firms exit the market.

Gross Worker Flows over the Life Cycle

joint with Tomaz Cajner and Toshihiko Mukoyama

Journal of Money, Credit and Banking 57, no 4 (2025): 757-791

We analyze the gross worker flows over the life cycle by constructing a quantitative general equilibrium model. Using US data, we first document the life-cycle patterns of flows across different labor market states (employment, unemployment, and not in the labor force), as well as job-to-job transitions. We then build a model of the aggregate labor market that incorporates the life cycle of workers, consumption-saving decisions, and labor market frictions. We estimate the model and use it to examine the effects of policies on aggregate labor market outcomes. In particular, we analyze a taxes-and- transfers policy and an unemployment insurance policy.

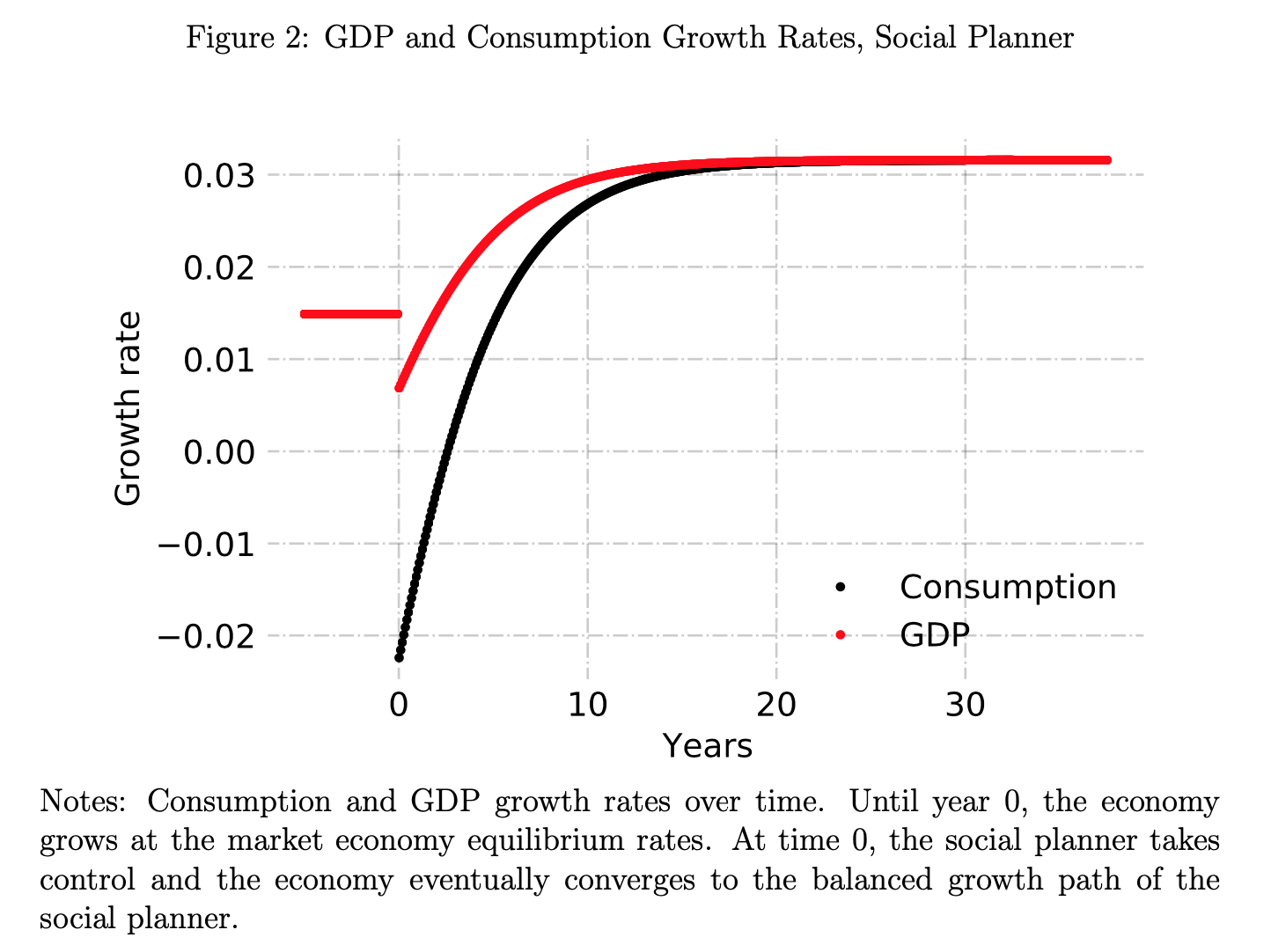

Growth and Welfare Implications of Sector-Specific Innovations

Review of Economic Dynamics 47 (2023): 204-245.

I examine the optimal government subsidy of R&D activities when sectors are heterogeneous. To this end, I build an endogenous growth model where R&D drives macroeconomic growth and firm dynamics in two sectors with different characteristics: a consumption-goods sector and an investment-goods sector. I highlight how various externalities in the innovation process affect the allocation of innovative resources across industries. I calibrate the model to U.S. data and study the quantitative properties of the model. By explicitly examining the transition path after the change in subsidy, I highlight the tradeoff between the short-run level of consumption and long-run growth. I find that the optimal combination of the subsidy rates, as a fraction of firm R&D expenditures, is 84 percent in consumption sector and 88 percent in investment sector. By moving from the baseline subsidy rates (10 percent in both sectors), society can achieve a 20 percent welfare gain in consumption equivalent terms. The annual GDP growth rate increases from 1.5 percent to 3.2 percent by this change in subsidy. Finally, I show that it is always optimal to subsidize R&D spending in investment sector at a higher rate than that in the consumption sector when the government’s subsidy budget is limited.

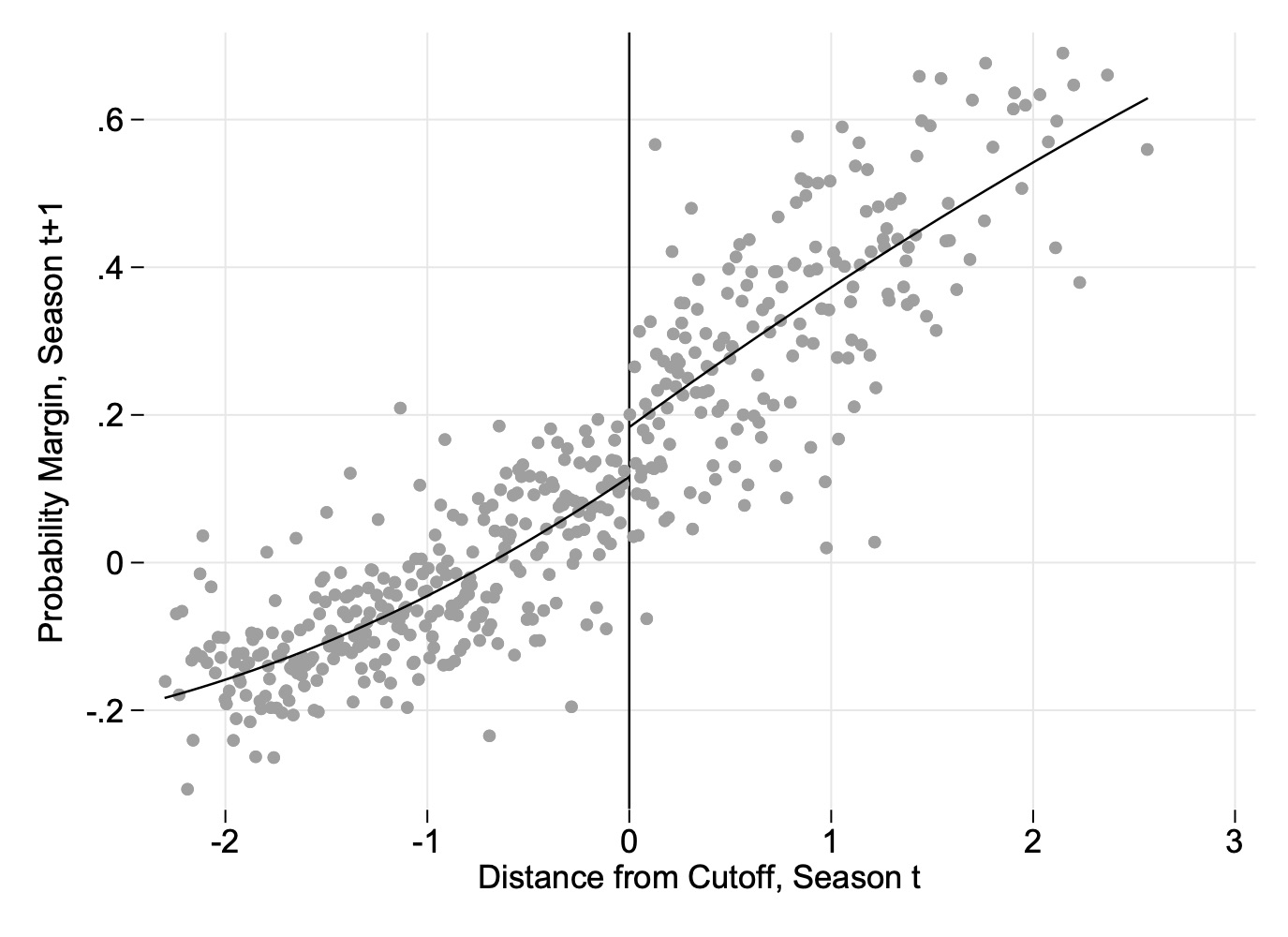

Dancing with the Stars: Does Playing in Elite Tournaments Affect Performance?

(joint with Mehdi Hamidi Sahneh)

Oxford Bulletin of Economics and Statistics 85, no. 1 (2023): 1-34.

This paper documents spillover effects using participation in an elite international football tournament as a laboratory. Using a novel dataset from top 5 European football leagues, we find that participation in highly selective UEFA Champions League (UCL) generates large performance gains to participating teams in their domestic leagues. More precisely, UCL participation improves goal difference (goals scored minus goals conceded) by approximately 0.3 goals per game and probability margin (probability of winning minus probability of losing) by approximately 10 percentage points. By investigating causal channels through which participation in the UCL might affect performance, we argue that our results suggest the importance of spillover effects in sports.